Ironically, the passing of data privacy legislation such as GDPR and CCPA has provided a potentially lucrative opportunity for fraudsters, which could cost organizations and their customers millions. Because these regulations make it difficult for organizations to capture data from customers who do not provide consent, many fraudsters are able to evade detection simply by opting out of data capture. Celebrus version 9.1 provides a simple yet effective means of overcoming this challenge, which we call Legitimate Interest data capture.

Anyone with an interest in data privacy and GDPR compliance, will be familiar with the term legitimate interest. For those less familiar, it is one of the six lawful bases for processing customer data, meaning that organizations can capture and process customer data provided that they can demonstrate that they are doing so in order to fulfill a contract or other legal or compliance obligations (more can be read about this here). Often this boils down to the processing taking place for the protection of the individual or the organization, or some other related benefit.

Many organizations interpret legitimate interest incorrectly and are using it as a basis to capture data for marketing purposes from non-consenting visitors to their digital channels. I will not go into a lengthy discussion of GDPR best practice here, but will simply make the point that the enterprise financial service clients who rely on Celebrus, know better than to mix the customer data that they capture for marketing purposes and the data they capture for legitimate interest. These are organizations who are under the utmost scrutiny from the regulators – they must be able to show that consent was provided for any data used for marketing, and must ensure that marketing teams do not have access to data collected for any other purpose.

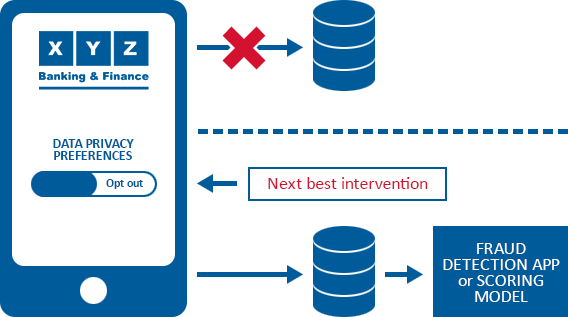

It may sound easy to capture data for different purposes and dynamically manage the separation of this data, but in practice, this is a significant challenge. As a result, many organizations only capture from opted-in visitors, meaning that valuable interaction data which could be used to detect fraud is being lost.

The Celebrus team developed the Legitimate Interest capture feature which ships with version 9.1, to enable clients to easily manage the capture of this data alongside marketing data. Celebrus can now capture all customer behavior, for every visitor to an organization’s digital property, regardless of the channel. With a minimum of configuration, this data can be captured in parallel with the behavioral data that the company has consent to capture, while ensuring the separation of these datasets to maintain compliance. As a result, while the organization is serving up a customer experience which is tailored to the individual in the moment for all of their opted-in users, in the background they are also protecting all of their customers and themselves from fraudsters, whilst remaining compliant.

Celebrus Legitimate Interest capture enables signals of fraudulent activity to be identified within milliseconds, and connects this data to enterprise systems with capabilities to prevent the fraudulent behavior from taking place before any loss has occurred. And the fact is, Celebrus is the only solution on the market to have developed this capability. Not only is no other data capture solution able to capture the detail that we can, but Celebrus was the first to understand the need to capture compliantly from non-opted in visitors and to create a solution to enable this. This innovation is just one example of our commitment to product leadership within the fields of data capture, compliance and security.