What you need to focus on

And what the heck affirmative express consent really means

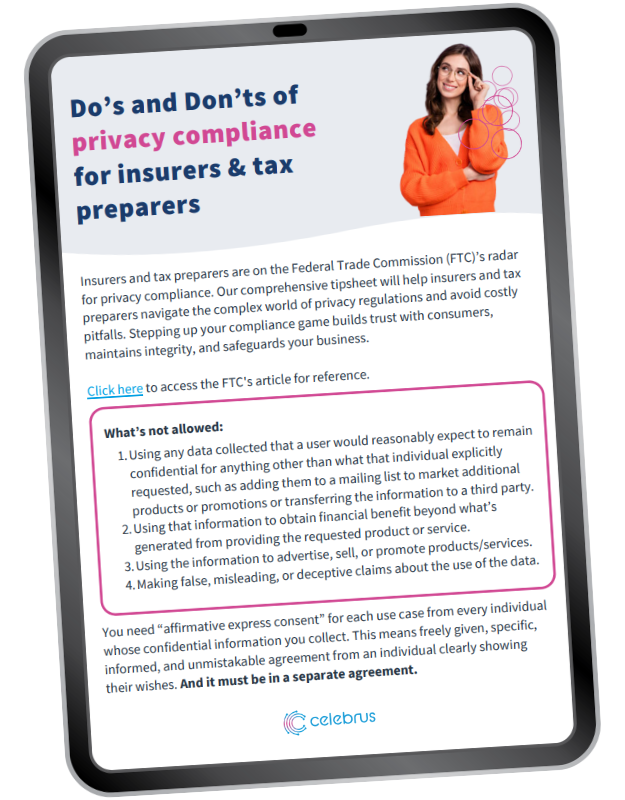

Insurers and tax preparers beware: The FTC is judging how you handle consumer data! Are you privacy compliant?

This tip sheet covers the do’s and don’ts of privacy regulations so your business can get — and stay — in the clear with the FTC.

And what the heck affirmative express consent really means

Hint: It's not a pretty picture

Proactive approaches to stay ahead of FTC guidelines

Simply adhere and you’re in the clear

The Federal Trade Commission (FTC) is cracking down on insurers and tax preparation companies that don’t protect consumer data and honor privacy concerns.

What’s the outlook for non-compliant businesses? Hefty fines, civil penalties, and costly pitfalls.

Keeping up with the FTC’s rules and regulations while maintaining consumer privacy expectations sounds complex, but it doesn’t have to be.

This tipsheet simplifies what insurers and tax preparers must focus on to stay compliant with privacy regulations.